Unknown Facts About Investment Advisors

For instance, one typical mistaken belief is that pension are assured. This is actually not the instance. While some programs give insurance for pension, like the FDIC for interest-bearing accounts and the SIPC for broker agents, these plans simply shield against reduction because of failure of the organization, not against loss as a result of market disorders. Numerous consider their 401( k)a promised retired life financial savings plan. But however, that is actually

certainly not the instance. A 401 (k)is an employer-sponsored pension that enables employees to contribute a part of their payday to a tax-deferred profile. investment advisors. The cash in the account can at that point be actually acquired different safety and securities, like shares, guaranties, as well as investment funds. The profile value are going to vary relying on the performance of the financial investments. For these reasons,

:max_bytes(150000):strip_icc()/dotdash_final_Want_to_Retire_in_5_Years_What_You_Must_Know_Dec_2020-01-6f884ac9429f49a59231c7fc08a3a6c6.jpg)

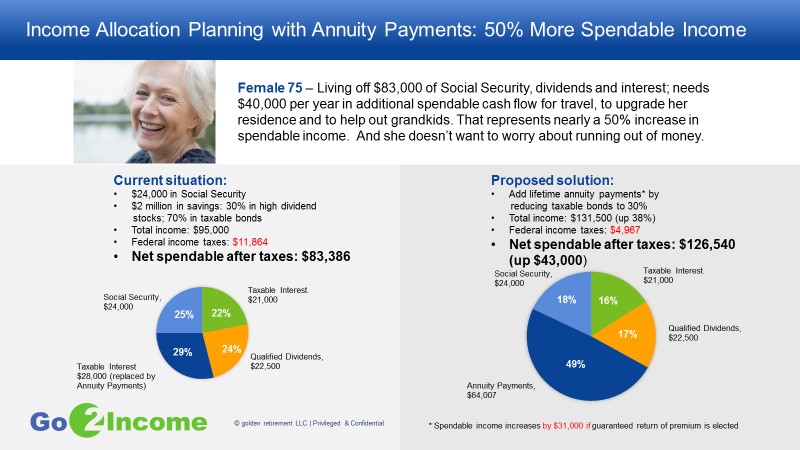

it is vital to understand that a 401 (k)is actually certainly not an assured retired life regard. It can easily still be actually an useful resource for building your nest egg. Pensions are often disregarded as retired life preparing devices, however they give many distinct benefits that could be surprisingly beneficial to retired people. Second, annuities are tax-deferred, so you are going to not must pay for usual profit tax obligation on your investment until you obtain settlements. Ultimately, allowances use life insurance payment and spousal advantages that may aid to give financial surveillance for your enjoyed ones. For these reasons, pensions are often considered the very most safe retirement life plan. If you are actually appearing for a risk-free assets portfolio that will give a surefire income flow, an annuity with a life-time income cyclist is the method to go. Through this type of annuity agreement, your payments are actually assured her latest blog despite exactly how long you reside, so you may rest ensured that your retired life savings will he has a good point never go out. With this kind of annuity, your enthusiasm is actually promised for a set time frame, so you know precisely just how much money you'll get each year. If you're appearing for an assets that possesses the potential to grow over opportunity, a preset index annuity is actually the correct selection for you. Index allowances carry out not shed amount of money to market volatility and must certainly not be actually perplexed along with a variable allowance (which can shed cash ).

7 Easy Facts About Investment Advisors Described

These workplace retirement plannings take advantage of a pension arrangement to supply lifetime revenue to retired employees. Pension advantages can be a vital retirement earnings resource, and typical pension plannings are actually typically one of the very most charitable earnings resources readily available. There are a number of questions that need to be responded to when you're organizing retirement life revenue.